Advertisement

-

Published Date

November 3, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

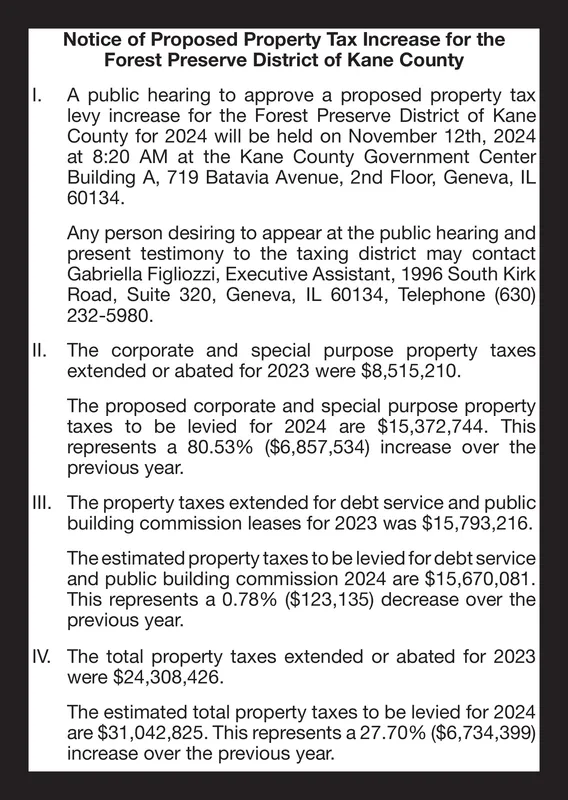

Notice of Proposed Property Tax Increase for the Forest Preserve District of Kane County A public hearing to approve a proposed property tax levy increase for the Forest Preserve District of Kane County for 2024 will be held on November 12th, 2024 at 8:20 AM at the Kane County Government Center Building A, 719 Batavia Avenue, 2nd Floor, Geneva, IL 60134. Any person desiring to appear at the public hearing and present testimony to the taxing district may contact Gabriella Figliozzi, Executive Assistant, 1996 South Kirk Road, Suite 320, Geneva, IL 60134, Telephone (630) 232-5980. II. The corporate and special purpose property taxes extended or abated for 2023 were $8,515,210. The proposed corporate and special purpose property taxes to be levied for 2024 are $15,372,744. This represents a 80.53% ($6,857,534) increase over the previous year. III. The property taxes extended for debt service and public building commission leases for 2023 was $15,793,216. The estimated property taxes to be levied for debt service and public building commission 2024 are $15,670,081. This represents a 0.78% ($123,135) decrease over the previous year. IV. The total property taxes extended or abated for 2023 were $24,308,426. The estimated total property taxes to be levied for 2024 are $31,042,825. This represents a 27.70% ($6,734,399) increase over the previous year. Notice of Proposed Property Tax Increase for the Forest Preserve District of Kane County A public hearing to approve a proposed property tax levy increase for the Forest Preserve District of Kane County for 2024 will be held on November 12th , 2024 at 8:20 AM at the Kane County Government Center Building A , 719 Batavia Avenue , 2nd Floor , Geneva , IL 60134 . Any person desiring to appear at the public hearing and present testimony to the taxing district may contact Gabriella Figliozzi , Executive Assistant , 1996 South Kirk Road , Suite 320 , Geneva , IL 60134 , Telephone ( 630 ) 232-5980 . II . The corporate and special purpose property taxes extended or abated for 2023 were $ 8,515,210 . The proposed corporate and special purpose property taxes to be levied for 2024 are $ 15,372,744 . This represents a 80.53 % ( $ 6,857,534 ) increase over the previous year . III . The property taxes extended for debt service and public building commission leases for 2023 was $ 15,793,216 . The estimated property taxes to be levied for debt service and public building commission 2024 are $ 15,670,081 . This represents a 0.78 % ( $ 123,135 ) decrease over the previous year . IV . The total property taxes extended or abated for 2023 were $ 24,308,426 . The estimated total property taxes to be levied for 2024 are $ 31,042,825 . This represents a 27.70 % ( $ 6,734,399 ) increase over the previous year .