Advertisement

-

Published Date

March 5, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

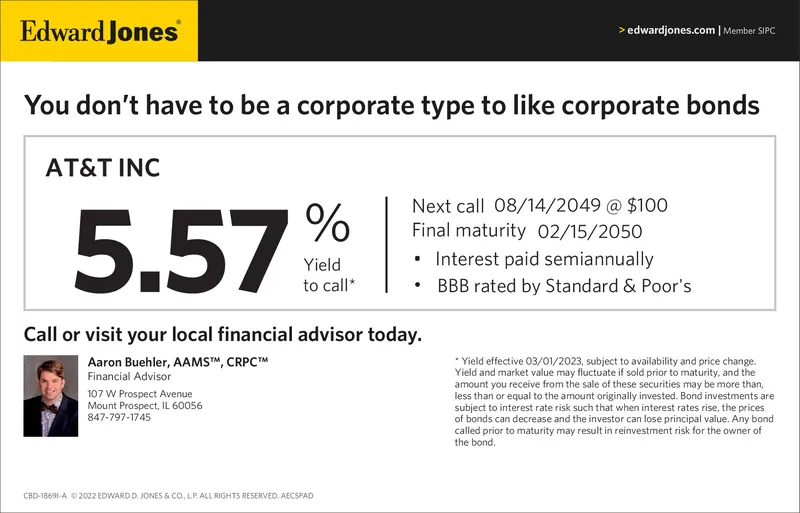

Edward Jones You don't have to be a corporate type to like corporate bonds AT&T INC 5.57% Yield 107 W Prospect Avenue Mount Prospect, IL 60056 847-797-1745 to call* CBD-18691-A © 2022 EDWARD D. JONES & CO., LP. ALL RIGHTS RESERVED. AECSPAD Next call 08/14/2049 @ $100 Final maturity 02/15/2050 Interest paid semiannually BBB rated by Standard & Poor's . Call or visit your local financial advisor today. Aaron Buehler, AAMS, CRPC Financial Advisor > edwardjones.com | Member SIPC . *Yield effective 03/01/2023, subject to availability and price change. Yield and market value may fluctuate if sold prior to maturity, and the amount you receive from the sale of these securities may be more than, less than or equal to the amount originally invested. Bond investments are subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease and the investor can lose principal value. Any bond called prior to maturity may result in reinvestment risk for the owner of the bond. Edward Jones You don't have to be a corporate type to like corporate bonds AT & T INC 5.57 % Yield 107 W Prospect Avenue Mount Prospect , IL 60056 847-797-1745 to call * CBD - 18691 - A © 2022 EDWARD D. JONES & CO . , LP . ALL RIGHTS RESERVED . AECSPAD Next call 08/14/2049 @ $ 100 Final maturity 02/15/2050 Interest paid semiannually BBB rated by Standard & Poor's . Call or visit your local financial advisor today . Aaron Buehler , AAMS , CRPC Financial Advisor > edwardjones.com | Member SIPC . * Yield effective 03/01/2023 , subject to availability and price change . Yield and market value may fluctuate if sold prior to maturity , and the amount you receive from the sale of these securities may be more than , less than or equal to the amount originally invested . Bond investments are subject to interest rate risk such that when interest rates rise , the prices of bonds can decrease and the investor can lose principal value . Any bond called prior to maturity may result in reinvestment risk for the owner of the bond .